Future of FinTech, DeFi and Token Economics

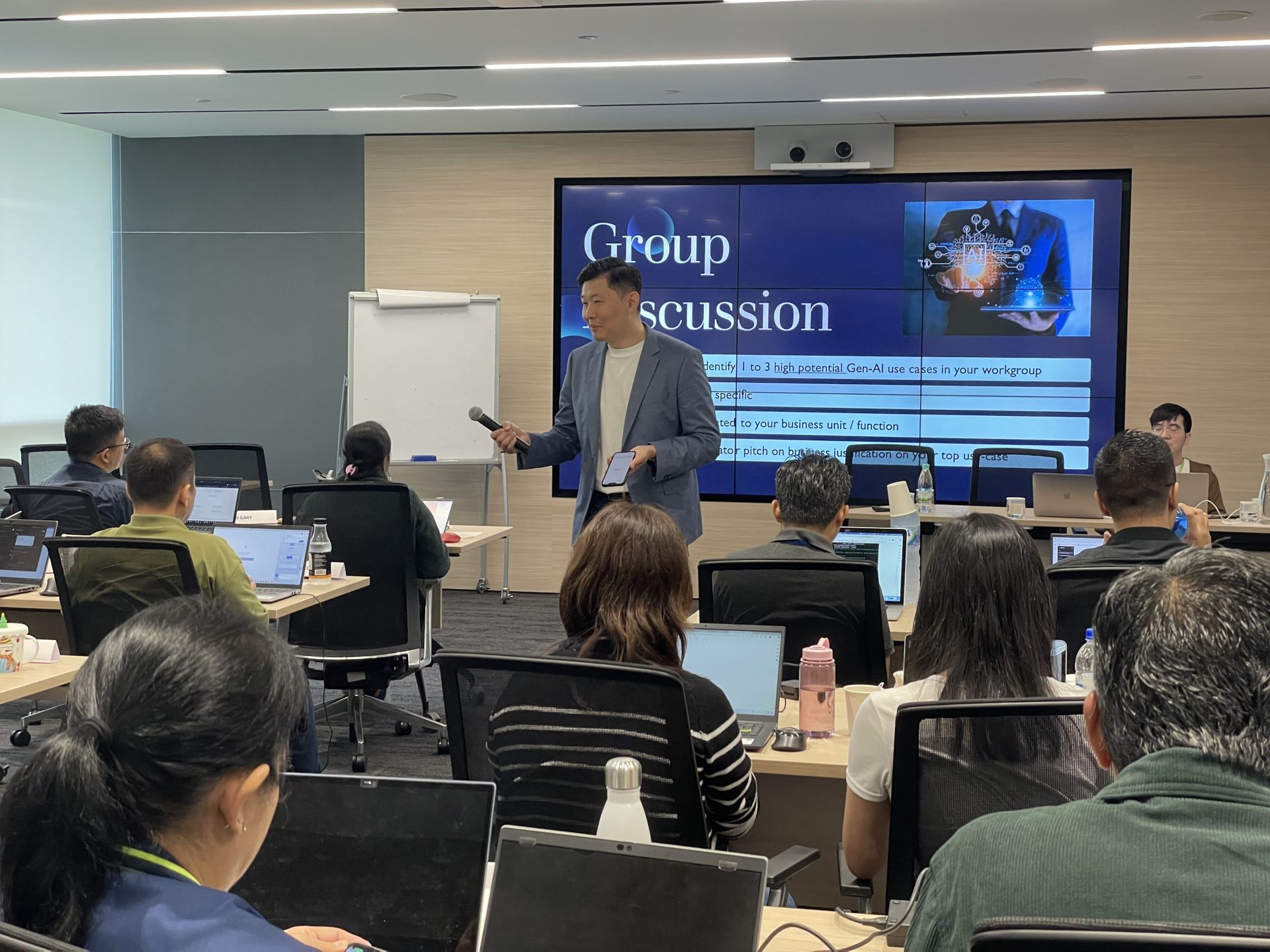

Technology is advancing at an accelerating rate and it can be difficult to keep track in this digital age. In just the last 20 years, the world has seen a fair share of repercussions from this evolution trickling into the finance and banking industries. From crowdfunding to digital currencies, the marriage of technology and traditional finance into a wholly new industry – Fintech – has and will continue to make waves around the world. What are these exciting developments, and what do they spell for traditional financial institutions across the world? This module aims to provide participants with a conceptual framework of the most exciting advancements in the financial industry, and an exploration of its implications and applications.

At the end of the 2-days course, participants will be able to:

- Understand DeFi, digital currencies and token economics in Web 3.0

- Explore the various types of digital currencies and token economics circulating in the market, and evaluate their risks

- Consider the pros and cons of DeFi and explore its potential in organisations

- Identify the efforts being taken by traditional financial institutions to adapt, such as

- Application Programming Interface (API) Banking;

- Open Banking; and

- Central Bank Digital Currency (CBDC)

- Understand the role of RegTech and its applications in Web 3.0

WHO SHOULD ATTEND

- Finance Professionals and Bankers: Individuals working within traditional financial institutions who want to stay ahead of the curve by understanding the latest advancements in Fintech and how they may impact their industry.

- Investment Managers and Advisors: Those looking to deepen their knowledge of emerging financial technologies and innovative wealth preservation strategies in a rapidly changing economic environment.

- Entrepreneurs and Start-up Founders in Fintech: Aspiring or established entrepreneurs who are interested in exploring new opportunities at the intersection of technology and finance.

- Policy Makers and Regulators: Individuals involved in the development and enforcement of financial regulations who need to understand the implications of Fintech innovations on the traditional financial landscape.

- Technology Enthusiasts: Anyone with a passion for technology and its potential to disrupt and reshape the financial industry, looking to gain insights into the future of finance.

- Academics and Researchers: Those studying finance, economics, or technology who are keen to explore the evolving relationship between finance and technology and its broader implications.

Course Duration

- 2-Days: 9 am to 5 pm

Course Fees

-

SGD 254.00* (*after max funding from SkillsFuture Singapore)

Patrick is the Managing Partner of Capital Sigma and G2M Digital, aiding over 20 blockchain firms with incubation services. He serves as Lead Advisor of Francium Protocol, a DeFi solution with a peak TVL of US$400M. With experience at Bybit, PwC, and BCG, he holds a First-Class Honours Degree from Nanyang Technological University.

Sonja leads the Hub’s central bank digital currency (CBDC) initiatives, including project Mariana and post-Dunbar multi-lateral CBDC arrangements. Seconded from the Monetary Authority of Singapore while on leave from the International Monetary Fund (IMF), she previously served as an Economist and Digital Expert at the IMF, offering capacity building and policy advice on digital currencies. With an MA from Bonn University and an MSc from Georgetown University, Sonja has authored numerous papers on financial technology and digital currencies. Before joining BIS, she worked as a Market Infrastructure Expert at the European Central Bank (ECB) on the digital euro investigation phase, contributing to G20 initiatives to improve cross-border payments.

FAQ

How would I know if my registration is successful?

After registration, you will be directed to payment if 1) there are no pre-requisites documents needed 2) application is within T-60 days

*Additionally, all successfully registered participants will receive a confirmation email 7 calendar days before course commencement.

What happens if the course I enrolled in is cancelled/postponed?

1) For cancelled courses -> SMU will cancel the enrolment and refund nett fees received.

2) For postponed courses -> SMU will transfer participant to the following date, if the participant is unable to attend, SMU will withdraw and refund nett fees received.

How can I claim my SkillsFuture Credits (SFC)?

There is no need to submit any external claims for SFC, you can apply it directly during the payment stage of your registration

How does registration under company-sponsored work?

You will need your company’s HR/manager to create a corporate account with SMU and generate a unique link (expires 5 days before course commencement) for the selected course.

You can then register using this link. *You are also required to create an individual account with SMU via SingPass

How can I receive my certification?

You will receive an email (registered under SingPass) when your cert (.opencert format) is ready. You can view and access it via your Skills Passport on the SkillsFuture portal or SMU student portal (eteams).

When will my certificate be ready?

1) Self-sponsored -> From the 14th working day after the course completion date.

2) Company-sponsored -> Within 14 working days upon receipt of payment.

How do I retreive receipts for my payment?

Login to your student portal and click on ‘View Invoices/Receipts‘

When do I make payment?

You should be redirected to the payment page upon successful registration. Alternatively, you can login to the student portal > ‘Outstanding Payment’ to make payment for the course.

How do I withdraw from a course?

SMU Academy applies an administrative charge of S$109.00 (inclusive of GST) for each request to withdraw from a course. To submit your request, you will need to fill up the post-enrolment form. All requests must be submitted by the course end date, otherwise nett course fee will be charged and non-refundable.

What is the attendance policy for the courses?

Participants must attain a minimum of 75% attendance in order to be awarded a Certificate from the Singapore Management University.